FREE

CASE

EVALUATION

WHY CHOOSE LYNCH LAWYERS

No Recovery, No Fee.

Here’s what “no recovery, no fee” means at our firm:

Your initial consultation is absolutely free.

There are no hourly fees.

You owe no up-front expenses as we work on your case.

You only pay us a percentage of your recovery when we win.*

Call us today for a free consultation: 201-500-6000.

No Upfront Costs:

You don't pay unless we WIN.*

We work on a contingency fee basis and will advance all costs for the prosecution of the case, which can approach $100,000.

Experienced, Trusted Lawyers With Proven Results.

We have been dedicated to the pursuit of justice for more than 20 years and will help you obtain the full compensation you truly deserve.

We Will Travel To You.

At no cost to you, our personal injury lawyers will travel anywhere to meet you to discuss your claim and your legal options.

Recent case results

Results may vary depending on your particular facts and legal circumstances.

$17,553,000

Medical Malpractice

New York County, NY

$8,500,000

Forklift Accident

Client was injured in a forklift accident.

$14,582,156

Construction Accident

Essex County

$8,290,000

Construction Accident

An asbestos worker fell over 15 feet and suffered a brain injury, resulting from careless fall protection planning.

$21,800,000

Auto Accident

An 11-year-old boy was hit crossing the street

$7,500,000

Pedestrian Accident

A pedestrian was struck by a fire engine while crossing the street and had to have one leg amputated.

What our clients say

For many, the recovery process after a personal injury involves hiring an attorney to handle the details of their case, as dealing with the insurance company or at-fault party on their own can be complicated. Choosing the right attorney is important to helping ensure your case is properly handled and that you obtain the compensation you need.

At

Lynch Law Firm, PC, our personal injury attorneys have decades of experience representing injury victims who have been harmed because of the negligence or wrongdoing of other individuals or large corporations. We are committed to fighting for your best interests and standing up for your rights.

Because of this commitment, our team only works on a contingency fee basis and does not charge any legal fees unless we obtain compensation for you. We also offer free, no obligation consultations to review the details of your claim and determine your legal options. Do not wait to contact our New Jersey personal injury lawyers today to learn more about how we can help you.

Results may vary depending on your particular fact and legal circumstances.

Our Practice Areas

Your Trusted Personal Injury Lawyers in New Jersey

At Lynch Law Firm, we specialize in providing dedicated and compassionate legal representation for individuals who have suffered due to the negligence of others. As experienced personal injury lawyers in New Jersey, our team is committed to ensuring you receive the justice and compensation you deserve. We proudly offer our expertise in a wide range of practice areas, including birth injury, wrongful death, car accidents, and workers’ compensation.

Why Choose Lynch Law Firm?

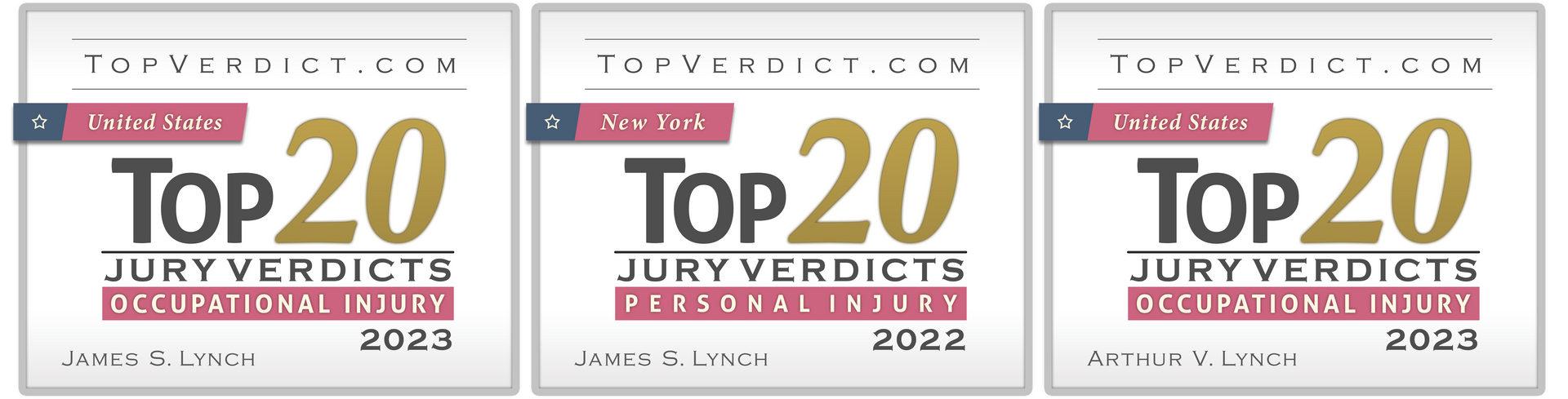

With over decades of experience, our New Jersey personal injury attorneys are known for their commitment to our clients and their results. Our team has earned the respect and trust of peers in the legal community, including being inducted into the Multi-Million Dollar Advocates Forum. Partner James Lynch has served on the Executive Board of the New Jersey Association for Justice and has been recognized by the New Jersey Law Journal’s Personal Injury Hall of Fame.

Both James and Arthur Lynch are Certified Civil Trial Attorneys by the Supreme Court of New Jersey, underscoring their dedication to fighting for the rights of injured individuals.

Our Practice Areas

Whether you’ve been involved in a car accident, suffered a brain injury, or experienced medical malpractice, Lynch Law Firm is here to guide you every step of the way. We handle cases related to:

- Personal Injury Law: From slip and fall accidents to dog bites, we fight for the compensation you deserve.

- Wrongful Death: Our New Jersey wrongful death lawyers help families who have lost loved ones due to negligence.

- Birth Injury: If your child has been injured during birth, we are experienced New Jersey birth injury attorneys ready to fight for you.

- Workers’ Compensation: We offer experienced representation for workers in need of New Jersey workers’ compensation lawyers.

- Car, Bus, and Motorcycle Accidents: We provide expert guidance for those injured in New Jersey bus accidents, motorcycle accidents, and hit-and-run incidents.

- Brain Injury: Our New Jersey brain injury lawyers have the knowledge and skill to handle the most complex cases.

- Mesothelioma and Burn Injuries: We support victims suffering from mesothelioma and burn injuries caused by accidents or exposure.

- Insurance and PIP: If you’re dealing with bad faith insurance claims or need help navigating New Jersey PIP insurance, our team is ready to assist.

- Disability and Social Security: We fight for veterans’ and disabled individuals as experienced veterans’ disability lawyers and social security disability benefits lawyers.

- Boating and Maritime Accidents: For accidents on the water, we provide skilled New Jersey maritime lawyers and boating accident lawyers.

Committed to Justice for All

Whether you’re facing a construction accident, a dog bite, or pedestrian accident, Lynch Law Firm stands by your side, fighting to secure your future. We proudly represent clients across New Jersey, including Hasbrouck Heights, Newark, and Passaic.

If you or a loved one have suffered from an injury or wrongful death, contact our team today to schedule a consultation. Let our New Jersey personal injury attorneys be the advocates you need to navigate the complex legal landscape and secure the compensation you deserve.

Get in Touch with Our New Jersey Personal Injury Lawyers

Don’t wait to seek the justice you deserve. Whether you need a New Jersey dog bite lawyer, car accident lawyer, or criminal defense attorney, we are ready to help. Call us today to discuss your case with one of our trusted New Jersey personal injury lawyers

MEET OUR TEAM

As seasoned New Jersey personal injury lawyers, the team at Lynch Law Firm, PC has earned the trust and respect of our peers. Through our staunch commitment to our clients, we have been accepted into the Multi-Million Dollar Advocates Forum.

Firm partner James Lynch was appointed to serve on the Executive Board of the New Jersey Association for Justice and has been inducted into the New Jersey Law Journal’s Personal Injury Hall of Fame for his dedication to fighting for the rights of the injured. Both James and Arthur Lynch are Certified by the Supreme Court of New Jersey as Civil Trial Attorneys.

Backed by decades of experience, we have the skills and resources to handle a wide variety of personal injury cases. You can trust that our team will fight to help you obtain the justice and maximum compensation you deserve.