BLOG

Options if a Driver Won’t Share Insurance

Even though New Jersey is a no-fault state, drivers are still expected to exchange insurance information after a crash. Remember that the property damage liability insurance of the at-fault driver should cover the costs of vehicle repairs. Also, if your injuries exceed the limits of your Personal Injury Protection (PIP) insurance, you may need to turn to the at-fault driver’s bodily injury liability insurance.

Even though New Jersey is a no-fault state, drivers are still expected to exchange insurance information after a crash. Remember that the property damage liability insurance of the at-fault driver should cover the costs of vehicle repairs. Also, if your injuries exceed the limits of your Personal Injury Protection (PIP) insurance, you may need to turn to the at-fault driver’s bodily injury liability insurance.

Unfortunately, there may be times when the at-fault driver refuses to exchange his or her insurance information with you. Below, we discuss some of your options for recovering that information if you are faced with this scenario.

If you have questions about your legal options to recover compensation, our New Jersey car accident lawyers are prepared to take your call. The consultation is free, and there are no upfront fees.

WHY WOULD THE DRIVER REFUSE TO PROVIDE INSURANCE INFORMATION?

If the other driver involved in the crash is refusing to provide his or her insurance information, there is usually a reason. Generally, that reason is that the driver does not have insurance. Since driving without insurance is illegal, he or she may be trying to avoid the consequences of doing so.

However, there are other reasons a driver who does have insurance may refuse to share his or her policy details with you, including:

- High premiums – The driver may already have high insurance premiums due to a poor driving record, and another claim on his or her policy may drive those costs even higher.

- Driving a borrowed vehicle – Although insurance generally covers drivers in a borrowed vehicle, some people may not be aware of this and refuse to provide insurance information until the rules for coverage are clear.

- Illegal driving – Someone who is driving while under the influence of alcohol or drugs, without a valid driver’s license or breaking some other traffic law may also refuse to provide insurance information to avoid having their actions on their insurance record.

- Disputing fault – when the other driver does not believe he or she is at fault for the collision

It is important to note that there is never a good reason to not cooperate with the other driver or police after a crash. However, some people may still try to justify their actions.

IS IT ILLEGAL TO REFUSE TO EXCHANGE INSURANCE INFORMATION?

In New Jersey, it is illegal to refuse to provide proof of insurance when operating a vehicle. Those who fail to do so can face serious consequences, including fines and suspension of a driver’s license.

However, providing insurance information when asked to do so by the police responding to a crash and to the other driver are different. The other driver may legally refuse to provide his or her insurance information to you but must provide it to the police.

If the driver can convince you not to call police to the scene, he or she would not be breaking the law by not providing insurance information. That is why it is important to always call the police after an accident. No matter what the other driver offers or tries to argue.

GET THE POLICE INVOLVED

It is generally always a good idea to call the police to the scene of an accident. It may be especially important when the other driver is not cooperating with you.

The driver is legally required to provide proof of insurance to police. That means the information you need will be on the police report. Once you have the police report, you can use the insurance information to file a claim.

While a police report is a useful tool to gather the information you need, it may not always be reliable. There could be errors on the report. That is why it is important to take other necessary steps after a crash.

GATHER OTHER IMPORTANT INFORMATION

After the accident, it is important to gather any information or potential evidence that could help you prove liability. Gathering this information could also help determine the insurance policy of the at-fault driver if he or she refuses to provide it to you.

Take photos of the vehicle that hit you. Make sure to get pictures of the license plate and the make/model of the car. If you cannot take photos of the necessary information for whatever reason, write it all down. This could help your attorney access the vehicle’s DMV records to find the insurance policy.

Also be sure to take note of the description of the driver. This, along with the vehicle description, could help an investigation if the driver flees the scene of the crash before police arrive.

CALL A LICENSED ATTORNEY

If the other driver is refusing to provide insurance information, you may still have some options for getting it. Our attorneys are prepared to help investigate your claim to gather the necessary information to pursue the compensation you need.

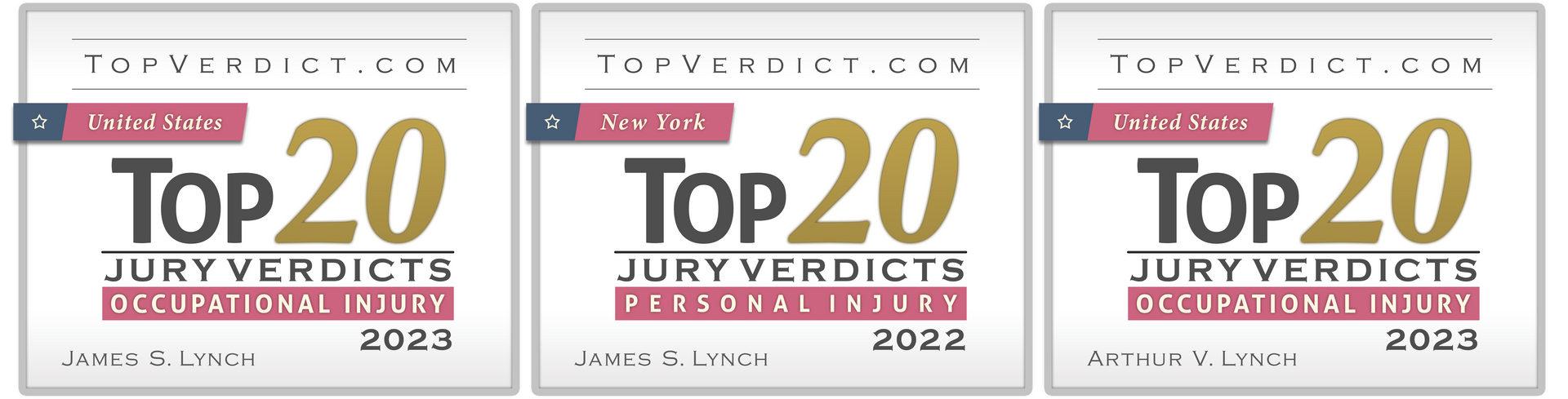

For decades, our firm has worked hard to secure compensation on behalf of our clients. Give us the opportunity to do the same for you.

Call (800) 518-0508 to schedule a free consultation.