BLOG

Out-of-State Driver Accident Claims

Plenty of drivers commute between Pennsylvania and New Jersey daily. Some also frequently travel from New York. Then there are drivers who come to the Garden State for vacation or to visit friends and loved ones. What happens if one of these out-of-state drivers causes an accident while in New Jersey?

Plenty of drivers commute between Pennsylvania and New Jersey daily. Some also frequently travel from New York. Then there are drivers who come to the Garden State for vacation or to visit friends and loved ones. What happens if one of these out-of-state drivers causes an accident while in New Jersey?

Call our New Jersey auto accident lawyers today to discuss your claim. The consultation is free and there are no upfront fees for our services.

Below, we discuss how no-fault insurance and other laws may affect your claim.

Which State’s Laws Take Precedent After an Accident?

If you are involved in an accident, the laws of the state in which it occurred take precedence. This means that out-of-state drivers who get into a car crash in New Jersey must adhere to the insurance laws of New Jersey, even if the driver is from somewhere like Florida or Michigan.

The minimum insurance requirements in New Jersey vastly differ from other states, as this is a choice no-fault state. This means drivers may choose between a basic or standard insurance policy. Each policy has a different minimum requirement. These minimums are as follows:

- Basic Policy

- Bodily injury liability option starting at $10,000 per accident

- $5,000 for property damage liability per accident

- Standard Policy

- $25,000 for bodily injury liability per person

- $50,000 for bodily injury liability per accident

- $5,000 for property damage liability per accident

Since New Jersey’s insurance laws are unique, it is likely the out-of-state driver who caused your collision may have more than the state’s minimum insurance requirements.

Additionally, because of the no-fault law in New Jersey, you should have your own Personal Injury Protection (PIP) of at least $15,000 to cover your medical expenses and some other damages.

Therefore, if you are injured in an accident with an out-of-state driver, you should be able to file a first-party claim. If your damages exceed your PIP limits, you should then be able to then file a third-party claim with the at-fault driver’s liability insurance policy.

Where claims may get complicated is if the crash is caused by a New Jersey resident and you are an out-of-state driver. This is especially true if you are not from a state with no-fault insurance laws and do not have PIP insurance. If this is the case, your medical bills may not get covered until the liability insurance of the resident driver who caused your crash kicks in.

Understanding the Deemer Statute in New Jersey

Fortunately, there is a law in New Jersey that is meant to protect out-of-state drivers in these situations. It is called the Deemer Statute.

The law essentially turns a non-New Jersey auto insurance policy into a New Jersey policy while the car is being driven in the state. Therefore, drivers from states like Connecticut, Michigan or even California are granted coverage under the Garden State’s $250,000 limit for PIP benefits.

How Does the Deemer Statute Affect the Verbal Threshold?

The drawback to the Deemer Statute is that these out-of-state drivers will not have the right to pursue compensation for non-economic damages like pain and suffering. This is because the Deemer Statute provides the equivalent of a basic New Jersey insurance policy for out-of-state drivers. Unfortunately, this limits an accident victim’s right to sue.

The only way an out-of-state driver may file a lawsuit for these damages is if he or she suffered a permanent injury , loss of a fetus or death.

What if the Driver is Also From a No-Fault State?

The Deemer Statute applies even when the out-of-state driver has a PIP policy on his or her insurance. Therefore, this statute also applies to drivers from Pennsylvania, New York or Florida.

What if I Was a Passenger in an Out-of-State Vehicle?

The Deemer statute does not apply to passengers riding in an out-of-state vehicle. It only applies to drivers. To recover compensation as a passenger, you must file a third-party claim with the liability insurance of the at-fault driver.

Injured in a Crash? Call Us Today

Accidents involving out-of-state drivers in New Jersey can be complicated cases.

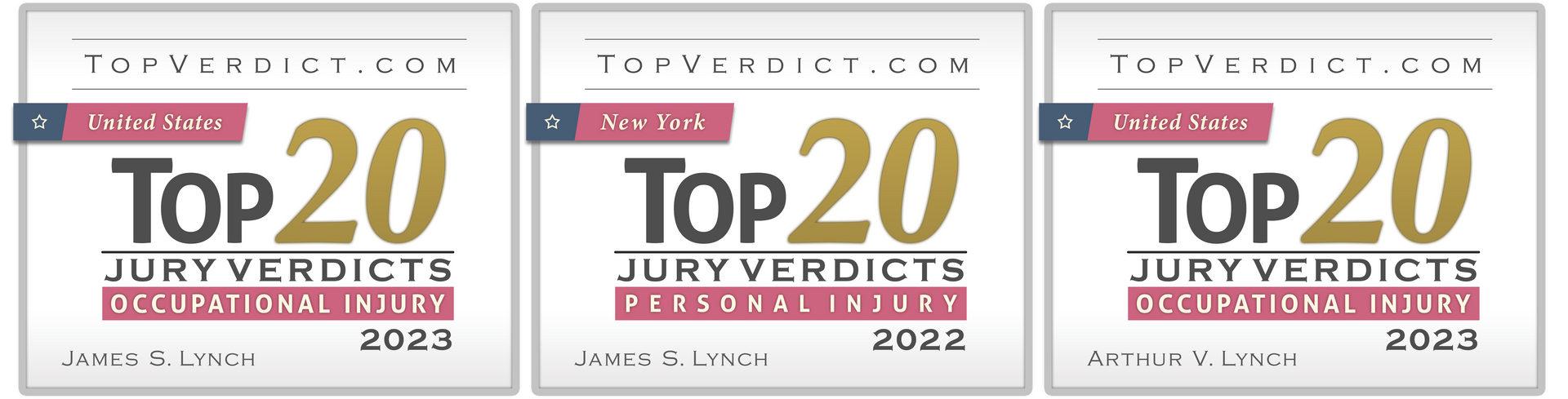

Our attorneys have decades of experience helping accident victims recover the compensation they need. We also have a track record of success , as we have recovered millions on behalf of our clients.*

If you were injured due to the negligence of another driver, we may be able to help you. Call us today to schedule a free consultation. There are no upfront fees if we take on your case.

Call (800) 518-0508 today.