How Insurance Companies Use Private Investigators to Try to Deny Personal Injury Claims

Posted on behalf of James Lynch on November 24, 2020 in Car Accident News. Updated on March 11, 2022

Insurance companies are for-profit businesses. That means they want more money coming in than going out. One of the best ways to do that is by denying as many claims as possible, or at the very least devaluing them and paying out the smallest amount of compensation they can.

Insurance companies are for-profit businesses. That means they want more money coming in than going out. One of the best ways to do that is by denying as many claims as possible, or at the very least devaluing them and paying out the smallest amount of compensation they can.

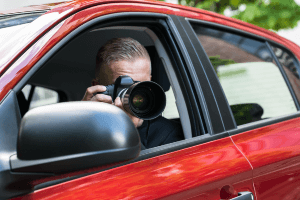

Insurance companies need a reason to undervalue a claim, which is why they sometimes hire private investigators to spy on accident victims. Below, learn more about what private investigators may look for and how it may be used against you.

If you have questions about your insurance claim, call our New Jersey car accident lawyers for assistance.

What is a Private Investigator Hired to Do?

Private investigators know how to follow a person while remaining mostly undetected. They also know how to look into someone’s background, including their finances and criminal record, if the victim has one. Private investigators may be able to discover things about an accident victim that could damage his or her credibility or dispute the severity of his or her injuries.

While we may think it is unethical for insurance companies to hire private investigators, from their perspective, they are protecting themselves. New Jersey ranked 22nd on a Federal Trade Commission list of states with the most insurance fraud. This might make insurance companies skeptical about the legitimacy of claims that are filed. They may hire private investigators if they suspect fraud or exaggerating of an injury.

Is it Legal for an Insurance Company to Hire Someone to Follow Me?

While hiring someone to follow you or your loved one may seem unethical and sneaky, it is not illegal. These are just some examples of things a private investigator is legally allowed to do:

- Monitor your social media

- Follow you home, to work, the grocery store, etc.

- Look through your public records

- Take photos of you while you are in a public setting

However, it is illegal for private investigators to do any of the following things:

- Wiretap your cell phone or home phone

- Take photographs through the window of a home

- Trespass onto private property

- Impersonate a law enforcement officer

- Present themselves as someone they are not

- Obtain protected information without consent

How Do I Know if a Private Investigator is Assigned to my Claim?

Private investigators are good at hiding in plain sight so they can gather the information they need from you while drawing as little attention to themselves as possible.

If you see a vehicle you do not recognize in your neighborhood, or the same vehicle over and over at the gas station, grocery store, bank or other places you frequent, it is possible you are being followed. Unfortunately, it may not be easy to spot a private investigator, particularly if this person is good at his or her job.

If your claim is for a severe injury, the insurance company will probably be looking for any way to devalue it. That means they may be more likely to hire someone to follow you.

Protecting Your Claim

Unless you exaggerated your injuries or are disobeying your doctor’s orders, you may not have much to worry about if the insurance company hired a private investigator. You should have nothing to hide. If you have any concerns, such as about a preexisting injury, talk to your lawyer about it. If the private investigator discovers it and tells the insurance company, you want your lawyer to be prepared.

What Other Surveillance Tactics Do Insurance Companies Use?

Thanks to the widespread and frequent use of social media and the Internet, insurers may not need to hire an investigator to learn more about you. Insurance adjusters could simply look at your Facebook profile.

Aside from social media posts, an insurance company may look for articles about you, photos of you or personal and business web pages to see if any information you provided them is inconsistent with what you have stated elsewhere.

Other surveillance tactics may be used before you even file a claim. Most motor vehicle insurance companies offer discounts for using their telematics devices, such as Progressive’s “Snapshot” program that can track where you go and what your driving is like.

Call a Licensed Attorney for Assistance

Our licensed attorneys have many years of experience dealing with insurance companies and we know the tactics they use to deny or devalue claims.

Give our offices a call today to discuss how we may be able to protect your rights. There are no upfront fees, which means you do not owe us anything unless we recover compensation on your behalf.

Call us today at (800) 518-0508 to schedule a free consultation.